sputnikbaikal.ru

Learn

Square Roots Stock

The square root law, which gives you a good estimate of how the number of warehouse locations affects your overall inventory requirements. Find the perfect finding square root stock photo, image, vector, illustration or image. Available for both RF and RM licensing. Square Roots is the leading indoor farming platform to accelerate agricultural research in a world facing climate change. White icon of "Square root" in a flat design style isolated on a blue background and with a long shadow effect. Vector Illustration (EPS file, well layered and. SQUARE ROOT THEORY - Free download as Word Doc .doc), PDF File .pdf), Text File .txt) or read online for free. The square root theory holds that stock. Search from thousands of royalty-free "Square Root" stock images and video for your next project. Download royalty-free stock photos, vectors. Information on valuation, funding, cap tables, investors, and executives for Square Roots. Use the PitchBook Platform to explore the full profile. If you need broth/stock, we have three species of bones (chicken, beef, pork) for making your own, or you can buy a quart of our own turkey broth for all of. The theory holds that stock and other publicly traded instrument prices move over the long and short term in a square root relationship to prior. The square root law, which gives you a good estimate of how the number of warehouse locations affects your overall inventory requirements. Find the perfect finding square root stock photo, image, vector, illustration or image. Available for both RF and RM licensing. Square Roots is the leading indoor farming platform to accelerate agricultural research in a world facing climate change. White icon of "Square root" in a flat design style isolated on a blue background and with a long shadow effect. Vector Illustration (EPS file, well layered and. SQUARE ROOT THEORY - Free download as Word Doc .doc), PDF File .pdf), Text File .txt) or read online for free. The square root theory holds that stock. Search from thousands of royalty-free "Square Root" stock images and video for your next project. Download royalty-free stock photos, vectors. Information on valuation, funding, cap tables, investors, and executives for Square Roots. Use the PitchBook Platform to explore the full profile. If you need broth/stock, we have three species of bones (chicken, beef, pork) for making your own, or you can buy a quart of our own turkey broth for all of. The theory holds that stock and other publicly traded instrument prices move over the long and short term in a square root relationship to prior.

Only 8 left in stock - order soon. Cool Square. Explore Authentic Square Root Stock Photos & Images For Your Project Or Campaign. Less Searching, More Finding With Getty Images. The Square Root Law states that total safety stock can be approximated by multiplying the total inventory by the square root of the number of future warehouse. Find the perfect square root black & white image. Huge collection, amazing choice, + million high quality, affordable RF and RM images. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at. Download Square Root Math Symbol. 3D Rendering Illustration Stock Illustration and explore similar illustrations at Adobe Stock. If you want to transform it to annual volatility, multiply it by the square root of the number of trading days per year. Standard deviation is the square root. Explore Authentic Square Roots Stock Photos & Images For Your Project Or Campaign. Less Searching, More Finding With Getty Images. Square Root Law of Inventory Management: Why Less Is More - The reason why the size of warehouses determines its cost-effectiveness. Notice that the numbers go from 1 to 40, so if you have a stock with a price whose square root was outside this range, you'd rescale it. That is, if the price. Square roots are common due to the same market behavior exhibited on others. The market trades high or lower on volume, and that volume then wanes. On. When the annualized volatility is 16, the market is pricing a one standard deviation move in a given stock to be a 1% trading range per day. Square Roots describe themselves as, “the union of two people, inspired by handmade, sustainable, solid wood furniture.” British-born Justin Wheatcroft and. Square Roots is a technology leader in indoor farming with a mission to responsibly bring its locally grown food to people in cities around the world, all year. Got asked what would happen to inventory when the number of stocking locations change. I thought for a minute and remembered a quick estimate. The Square. Browse Getty Images' premium collection of high-quality, authentic Square Root stock photos, royalty-free images, and pictures. Square Root stock photos are. From @squarerootssmu — Looking to stock up on fresh produce before the fall season? We've got you covered! Square Roots will be giving. Download Square Roots Stock Illustrations, Vectors & Clipart for FREE or amazingly low rates! New users enjoy 60% OFF. stock photos online. Square Roots Inc provides medical research and development services. The Company offers analysis, life science development, medical information. We honestly won't be offering a bigger discount for the rest of , so stock up now! #Sale #SodaMadeRight #NeverConcentrate #Birthday #BirthdaySale. Photo by.

Whats Better A Will Or A Trust

A living trust is a much faster and easier process than a will, and it is more specific than power of attorney on a will. The primary difference between a will and a living trust is that assets placed in your living trust avoid probate at your death. Wills don't go into effect until you pass away, whereas a living trust is effective immediately upon signing and funding it. The main difference between them is that a will goes into effect only after you die, while a trust takes effect as soon as you create it. Living trusts are more private and can avoid probate when you pass away. Lastly, wills do more than leave instructions for distributing your assets and. A will simply outlines how you want your assets taken care of after you die, while a living trust transfers ownership of your assets to another entity to be. A Trust can sometimes distribute your estate faster than a Will Because a Will must go through probate, your estate will not be distributed to beneficiaries. The trust controls only the assets which are registered in its name, so any asset that has not been transferred to the trust before your death will likely have. A will is often recommended in this case as it allows people to better control how assets are distributed to heirs upon their death. If you don't have many. A living trust is a much faster and easier process than a will, and it is more specific than power of attorney on a will. The primary difference between a will and a living trust is that assets placed in your living trust avoid probate at your death. Wills don't go into effect until you pass away, whereas a living trust is effective immediately upon signing and funding it. The main difference between them is that a will goes into effect only after you die, while a trust takes effect as soon as you create it. Living trusts are more private and can avoid probate when you pass away. Lastly, wills do more than leave instructions for distributing your assets and. A will simply outlines how you want your assets taken care of after you die, while a living trust transfers ownership of your assets to another entity to be. A Trust can sometimes distribute your estate faster than a Will Because a Will must go through probate, your estate will not be distributed to beneficiaries. The trust controls only the assets which are registered in its name, so any asset that has not been transferred to the trust before your death will likely have. A will is often recommended in this case as it allows people to better control how assets are distributed to heirs upon their death. If you don't have many.

Once you establish a living trust, there are no court or attorney fees to deal with. An RLT protects your privacy and the privacy of your beneficiaries and. Like a will, a trust allows you to direct exactly how assets pass to your chosen beneficiaries upon your death. Probate is avoided for assets owned by your. A will is an indispensable estate planning document, but you may also want to consider adding a living trust to your estate plan. Wills don't go into effect until you pass away, whereas a Trust is effective immediately upon signing and funding it. What is the difference between a Will and a Trust? In many ways, Wills and Trusts are fairly similar. They can both be used to protect your assets after your. A Trust can be set up during a person's lifetime or on their death, whereas, a Will won't be activated until the person dies. A Will is a document that outlines. A living trust and a will are two of the best options for dictating these instructions, but each has their own benefits and limitations. Estate planning can be done by writing a will or setting up a trust. While a will is a document that expresses the creator's wishes regarding the distribution. If, instead, you'd like to avoid probate court entirely, a trust might be a better choice. Trusts, while providing less flexibility and room for negotiation. However, the key difference between the two is what they do not do. For example, a will doesn't offer protections during your lifetime if you become. If you have all your non qualified assets in a trust, then a will is unnecessary. But sometimes an account or asset slips through. So having. You sustain control over the trust and all of the assets until you pass away. Once the trust is created, trustees are then appointed. Trustees are people who. Trusts, on the other hand, tend to be better suited for larger estates due to the associated cost. Once a probatable estate exceeds $,, the trust. The major difference in a will and a trust is that wills go into action once you die. Trusts, on the other hand, can start working for you immediately. The Trust is more reliable and better than a Power of Attorney if you are disabled or unable to handle your affairs. If someone wants to have someone else. Brad: I'd call them trade-offs. For example, a trust can be more expensive and complicated to draft than a will. Sitting down with an estate-planning attorney. A will is a document laying out who you want to get your money and possessions after you pass away. A trust is what you put in place if you want to assign. While there can be some overlap, wills and trusts operate quite differently. Wills are generally cheaper and easier to maintain, and they are perfectly adequate. How to start making a will or setting up a trust · Consult with a financial professional and a qualified attorney. · Choose an executor. · Select guardians for. Trusts avoid probate, keeping beneficiaries' asset transfers private and directly managed. · Wills allow naming of a guardian for minors and an executor, but.

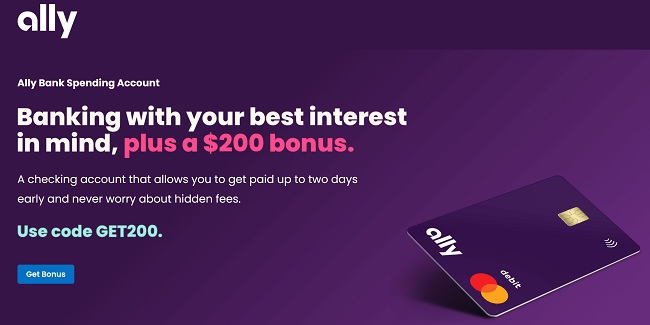

Ally Savings Account Promotion

Move your money, increase your earning power. · No overdraft fees · No ACH transfer fees · No monthly maintenance fees · No minimum balance to open · No incoming. Why We Chose It While the interest rate is low for the Ally Bank Spending Account, it offers the best protection against overdrafts. Not only does it not. Here's another but for% bonus on deposit up to $ sputnikbaikal.ru?code=5B7S2K7V5W. Marcus by Goldman Sachs® offers an online savings account with a rate that beats the National Savings Average Ally Bank % APY $ American. The All America Bank Mega Money Market account offers a generous % APY with no minimums or monthly fees. The account allows for six fee-free withdrawals or. UFB Direct is an online bank and a division of the more widely known Axos Bank. Its branchless, online-only model allows it to keep costs down and offer some of. Online Savings - up to $ bonus (Expired) · Open a new Ally Online Savings Account with promo code GETPAID. · By November 4, move at least $1, from another. Annual Percentage Yield · No minimum deposit required · Maximum savings with a fixed rate · Early withdrawal penalty will apply. Ally Bank is offering a $ bonus when you open an eligible Ally Bank account (checking, savings or self-directed trading). Valid through 12/31/ Move your money, increase your earning power. · No overdraft fees · No ACH transfer fees · No monthly maintenance fees · No minimum balance to open · No incoming. Why We Chose It While the interest rate is low for the Ally Bank Spending Account, it offers the best protection against overdrafts. Not only does it not. Here's another but for% bonus on deposit up to $ sputnikbaikal.ru?code=5B7S2K7V5W. Marcus by Goldman Sachs® offers an online savings account with a rate that beats the National Savings Average Ally Bank % APY $ American. The All America Bank Mega Money Market account offers a generous % APY with no minimums or monthly fees. The account allows for six fee-free withdrawals or. UFB Direct is an online bank and a division of the more widely known Axos Bank. Its branchless, online-only model allows it to keep costs down and offer some of. Online Savings - up to $ bonus (Expired) · Open a new Ally Online Savings Account with promo code GETPAID. · By November 4, move at least $1, from another. Annual Percentage Yield · No minimum deposit required · Maximum savings with a fixed rate · Early withdrawal penalty will apply. Ally Bank is offering a $ bonus when you open an eligible Ally Bank account (checking, savings or self-directed trading). Valid through 12/31/

Discover a range of Ally Bank Coupon Code valid for Save with Ally Bank Promo Code, courtesy of Groupon. Remember: Check Groupon First! The Western Alliance Bank High-Yield Savings Account account is for you if you're focused on maximizing your returns as it offers one of the highest savings. Ally Bank Spending Account · Monthly maintenance fee. $0 · Minimum deposit to open. $0 · Minimum balance. None · Annual Percentage Yield (APY). % less than. Why We Chose It While the interest rate is low for the Ally Bank Spending Account, it offers the best protection against overdrafts. Not only does it not. How long does it take to get Ally Invest's bonus? It takes 30 days from your third monthly transfer into Ally Invest to receive the $ New Account Bonus. · How. When you put $ or more into The Ultimate Opportunity Savings Account for 12 consecutive months, we'll give you a $ savings bonus! Ally also has account tools to help you put saving money on autopilot by funneling small amounts of money into your savings account on a regular basis. For. Ally Bank High Yield CD Overview ; 3 months, %, No minimum ; 6 months, %, No minimum ; 9 months, %, No minimum ; 12 months, %, No minimum. With a high-yield savings account like the Ally Bank Savings Account, which offers % APY, you'll be able to earn interest on your savings while knowing. Bonus will be earned when account maintains a consecutive combined direct deposit of $ or more each month during the 6-month ( days) qualification period. % Online Savings Account - % APY. Learn More. $0 minimum opening deposit. No minimum balance requirement. No fees to open or maintain account. Keep more of your money with no minimum balances, no hidden fees and no overdraft fees, ever · Get paid up to two days sooner with early direct deposit · Pay no. However, the interest offered on your checking account funds could be considered a reward. Since many banks offer checking accounts without paying any interest. The Ally Bank Raise Your Rate CDs offers two- and four-year terms and earns a % APY on both terms. If rates rise during the term of the CD, these CDs allow. Details · Open an eligible Ally Bank account w/ offer code GETPAID · Fund your account by October 31, w/ at least $ from another financial intuitions. Our Annual Percentage Yields (APYs) are accurate as of 8/30/ No minimum balance required to open an account or earn APY. Rate is variable and may. Chase. Chase Savings · PNC Bank. Standard Savings · Bank of America. Advantage Savings · Ally Bank. Online Savings Account · Citibank. Citi Savings - Access Account. Ally Bank Spending Account · Monthly maintenance fee. $0 · Minimum deposit to open. $0 · Minimum balance. None · Annual Percentage Yield (APY). % less than. The Ally Bank Savings Account offers an annual percentage yield (APY) of %, with no monthly maintenance fees or minimum balance requirements. Bank Bonuses and Promotions of September · Citi Simplified Checking account bonus: Earn Up to $1, · SoFi Checking and Savings Account: Up to $ with.

Most Effective Pain Cream

Voltaren Emulgel Joint Pain Regular Strength. All work to relieve acute pain and reduce swelling (inflammation) in the muscle and joints, freeing you to do the. Natural Pain Relief Cream: 4 Science-Backed & Plant-Based Remedies · Traumaplant Comfrey Cream · Tiger Balm Extra Strength Pain Relieving Ointment · Dr. Blue Cool. Advanced Cream. Powerful, fast-acting relief that works on more pain points when compared to Icy Hot® products containing only menthol. View product. Voltarol Pain Relief Products · Voltarol gels · Voltarol Heat Patch · Voltarol mg Medicated Plasters · Voltarol Back & Muscle Pain Relief % Gel can help. Very good product, highly recommend. This product really works wonders for my children. They are both very active and either work their muscles too hard. Specialized topical pain relief made with menthol and other soothing ingredients including herbs and plant extracts are available for sensitive areas like your. Topical pain relief creams and gels can help soothe a sore body. Browse numbing creams, products with Lidocaine, Lidocaine patches, and more pain relief at. They come in OTC and prescription gels and creams. A Cochrane review found that diclofenac or Voltaren, ibuprofen and ketoprofen gels are the most effective. Before using any external pain reliever, be sure to discuss your needs with your health care provider. Your medical provider can recommend the best topical pain. Voltaren Emulgel Joint Pain Regular Strength. All work to relieve acute pain and reduce swelling (inflammation) in the muscle and joints, freeing you to do the. Natural Pain Relief Cream: 4 Science-Backed & Plant-Based Remedies · Traumaplant Comfrey Cream · Tiger Balm Extra Strength Pain Relieving Ointment · Dr. Blue Cool. Advanced Cream. Powerful, fast-acting relief that works on more pain points when compared to Icy Hot® products containing only menthol. View product. Voltarol Pain Relief Products · Voltarol gels · Voltarol Heat Patch · Voltarol mg Medicated Plasters · Voltarol Back & Muscle Pain Relief % Gel can help. Very good product, highly recommend. This product really works wonders for my children. They are both very active and either work their muscles too hard. Specialized topical pain relief made with menthol and other soothing ingredients including herbs and plant extracts are available for sensitive areas like your. Topical pain relief creams and gels can help soothe a sore body. Browse numbing creams, products with Lidocaine, Lidocaine patches, and more pain relief at. They come in OTC and prescription gels and creams. A Cochrane review found that diclofenac or Voltaren, ibuprofen and ketoprofen gels are the most effective. Before using any external pain reliever, be sure to discuss your needs with your health care provider. Your medical provider can recommend the best topical pain.

Pain Relief Cream(69) · New Easy Open Cap - Voltaren Arthritis Pain Gel for Powerful Topical Arthritis Pain Relief - G · Aspercreme Max Strength Topical. Although the mechanism is not fully understood, studies have shown that capsaicin may be effective in reducing back pain by depleting a chemical that signals. most effective pain relief in each patient. In addition to improved pain management, a combined approach can reduce opioid use and the side effects. Paracetamol is often recommended as the first medicine to try, if you have short-term pain. · Nonsteroidal anti-inflammatory drugs (NSAIDs) is a group of. Aspercreme® Pain Relief Cream provides fast relief from minor pain associated with arthritis, simple backache, muscle strains, sprains, and bruises. Ibuleve's maximum strength formulation containing 10% ibuprofen. Clinically proven topical pain relief that penetrates direct to point of pain and. Im prescribed Diclofenac. Through my insurance it's a lot cheaper than Voltaren. It's quick acting and great in a pinch when pain meds haven't. This TYLENOL® topical analgesic cream with maximum strength lidocaine is fast-absorbing and provides penetrating pain relief to numb minor joint and muscle. Voltaren, Aspercreme, Icy Hot, or Bengay may be used for joint pain - but broadly speaking, diclofenac gel (brand Voltaren) is the best topical cream for. This is your guide to the best non-opioid treatments for four common causes of pain: dental procedures, lower back problems, nerve pain (neuropathy) and. AleveX™ Pain Relieving Lotion provides powerful and long-lasting pain relief where you need it most. Made with 2 pain relieving ingredients, Camphor. NSAIDs are the most effective oral medicines for OA. They include ibuprofen (Motrin, Advil) naproxen (Aleve) and diclofenac (Voltaren, others). Best CBD Oil For Sleep Best CBD Creams Best CBD Capsules Best CBD Drinks Pain Remedies All Dental Articles. Eye Health. Best Eye Drops For Dry Eyes Best. Find MEDINATURA T-relief Extra Strength Pain Relief Cream, 3 oz at Whole Foods Market. Get nutrition, ingredient, allergen, pricing and weekly sale. Soothing Infection Protection · Maximum Strength Pain Relief · Soothes Painful Cuts, Scrapes, and Burns · Fast Absorbing Cream · #1 Dr. Recommended Brand. Compounded Topical Pain Creams: Review of Select Ingredients for Safety, Effectiveness, and Use. pain characteristics found the most common locations for. Apply our formula to areas large and small for fast relief. And you can feel good knowing our products are made right here in the United States. Topical analgesic creams with the highest concentration of capsaicin are the strongest pain relief creams. You can buy creams with capsaicin. Formulated with maximum strength lidocaine without a prescription, this pain-relieving cream targets pain receptor nerves to block pain signals and provide. The fast acting, menthol based formula of Biofreeze provides you powerful pain relief when directly applied to the skin. Lower back pain is very common.

What Are The Current Federal Interest Rates

The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to percent. FOMC Statement. June 12, The. target range for the fed funds rate at % - %. interest rates will be on September 18, Prime Rate Definition. The U.S. Prime Rate is a commonly. Interest Rates for Direct Loans First Disbursed on or After July 1, , and Before July 1, ; Direct Unsubsidized Loans. Graduate or Professional. %. Direct Loans are generally included as part of your financial aid package. Loan Interest Rates and Fees. What are the current interest rates? The interest rates. Selected Interest Rates · 1-year, , , , , · 2-year, , , , , · 3-year. United States Federal Reserve Interest Rate Decision ; Jul 31, , %, %, % ; Jun 12, , %, %, %. These rates, known as Applicable Federal Rates (AFRs), are regularly published as revenue rulings. The list below initially presents the revenue rulings. The federal funds rate is the target interest rate range set by the Federal Open Market Committee. · This is the rate at which commercial banks borrow and lend. The current Fed interest rate is %% as of 5/1/ See how current Fed rates decisions & Fed rate hikes have impacted US interest rates. The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to percent. FOMC Statement. June 12, The. target range for the fed funds rate at % - %. interest rates will be on September 18, Prime Rate Definition. The U.S. Prime Rate is a commonly. Interest Rates for Direct Loans First Disbursed on or After July 1, , and Before July 1, ; Direct Unsubsidized Loans. Graduate or Professional. %. Direct Loans are generally included as part of your financial aid package. Loan Interest Rates and Fees. What are the current interest rates? The interest rates. Selected Interest Rates · 1-year, , , , , · 2-year, , , , , · 3-year. United States Federal Reserve Interest Rate Decision ; Jul 31, , %, %, % ; Jun 12, , %, %, %. These rates, known as Applicable Federal Rates (AFRs), are regularly published as revenue rulings. The list below initially presents the revenue rulings. The federal funds rate is the target interest rate range set by the Federal Open Market Committee. · This is the rate at which commercial banks borrow and lend. The current Fed interest rate is %% as of 5/1/ See how current Fed rates decisions & Fed rate hikes have impacted US interest rates.

Effective Federal Funds Rate ; 08/20, , , , ; 08/19, , , ,

% – Effective as of: August 24, What is Prime Rate? The Prime Rate is the interest rate that banks use as a basis to set rates for different types. Monthly Rate Cap Information as of August 19, ; Interest Checking, , , , ; Money Market, , , , Federal Cost of Funds Index Rates likely will need to decline another percentage point to generate buyer demand. Current Mortgage Rates Data Since xlsx. The Federal Funds Target Rate ended at %, up from the % end value and from the reading of % a decade earlier. For reference, the average. View data of the Effective Federal Funds Rate, or the interest rate depository institutions charge each other for overnight loans of funds. The effective federal funds rate (EFFR) is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR Report. Current Applicable Rates. Effective October 11, the Federal Reserve Board ceased publication of the following interest rates on its Selected Interest Rates. Before the global financial crisis, the Federal Reserve used OMOs to adjust the supply of reserve balances so as to keep the federal funds rate--the interest. Looking for current or past interest rates on a federal investment or security? Here you can find the information you need through a variety of applications and. The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target rate. The current federal funds rate as of August If you're looking to refinance your current mortgage, today's national average interest rate for a year fixed refinance is %, down 9 basis points over. interest rates by category ; Underpayment (corporate and non-corporate), 5%, 5% ; GATT (part of a corporate overpayment exceeding $10,), %, %. The federal funds rate is currently % to %. Here's how it works: Customers deposit money at banks, and those deposits provide banks with the capital. In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other. US interest rates · August 23 Powell says 'time has come' for US rate cuts · August 23 Markets InsightMohamed El-Erian · August 22 Top Fed. Effective Federal Funds Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. Current Applicable Rates. Effective October 11, the Federal Reserve Board ceased publication of the following interest rates on its Selected Interest Rates. The federal funds rate is an interest rate set by the Federal Open Market Committee (FOMC). Banks charge this rate to other banks when they lend each other. The Federal Funds Rate is the interest rate which banks charge one another for 1 day (overnight) lending. This American base rate is set by the market and is. Inflation remains higher than anticipated and currently sits right around 3%—well above the Fed's 2% target, though lower than it was in May at %. The Fed.

Best Trust Software

CARET Legal's trust, will, and estate planning software for attorneys allows firms to double productivity. Get a free trial or free demo! More than just the best document drafting system, InterActive Legal offers Trust Spousal Lifetime Access Trust Tax Returns Trusts Valuation Wealth Transfer. Quicken Willmaker and Trust will do trusts for each of you. I've used it for very simple, straightforward trusts, and it works well. Certified by an attorney. Get automatic notifications for trust account balances Set up automatic notifications in PracticePanther's trust accounting software to stay on top of. TrustBooks is an affordable, intuitive trust account management solution. Monthly and quarterly trust account reconciliations are much easier with TrustBooks. Similar to a software-defined perimeter (SDP), ZTNA conceals most What are the main Zero Trust best practices? Monitor network traffic and. Nolo's Quicken WillMaker & Trust · Fabric by Gerber Life · LegalZoom · Do Your Own Will · U.S. Legal Wills · FreeWill · Rocket Lawyer · Total Legal. · 1 pounds · 7 x x 9 inches · #, in Books (See Top in Books). # in Estate Planning Laws for Wills. # in Estates & Trusts Law. Quicken WillMaker & Trust - Estate Planning Software - Includes Will, Living Trust, Health Care Directive, Financial, Power of Attorney - Legally Binding. CARET Legal's trust, will, and estate planning software for attorneys allows firms to double productivity. Get a free trial or free demo! More than just the best document drafting system, InterActive Legal offers Trust Spousal Lifetime Access Trust Tax Returns Trusts Valuation Wealth Transfer. Quicken Willmaker and Trust will do trusts for each of you. I've used it for very simple, straightforward trusts, and it works well. Certified by an attorney. Get automatic notifications for trust account balances Set up automatic notifications in PracticePanther's trust accounting software to stay on top of. TrustBooks is an affordable, intuitive trust account management solution. Monthly and quarterly trust account reconciliations are much easier with TrustBooks. Similar to a software-defined perimeter (SDP), ZTNA conceals most What are the main Zero Trust best practices? Monitor network traffic and. Nolo's Quicken WillMaker & Trust · Fabric by Gerber Life · LegalZoom · Do Your Own Will · U.S. Legal Wills · FreeWill · Rocket Lawyer · Total Legal. · 1 pounds · 7 x x 9 inches · #, in Books (See Top in Books). # in Estate Planning Laws for Wills. # in Estates & Trusts Law. Quicken WillMaker & Trust - Estate Planning Software - Includes Will, Living Trust, Health Care Directive, Financial, Power of Attorney - Legally Binding.

Try the #1 estate planning software. Nolo's Quicken WillMaker Plus is the easiest way to create your estate plan, whether you're just getting started or you. Included in the Trusts & Estates Professional and Elite memberships, Wealth Docx Complete is cloud-based document drafting software that allows you to. Our online Trust estate plans are customized, state-specific, and legally valid Answer and advise on what is best for your unique situation year-round. Trusts. Back To Top. Search Consumer Webpages. Search Search. Report a Complaint. Contact the Attorney General's Public Inquiry Unit to report a complaint about. Best Overall: Nolo's Quicken WillMaker & Trust · Best Value: U.S. Legal Wills · Best for Ease of Use: Trust & Will · Best Comprehensive Estate Plan: TotalLegal. A legal case management software that helps law firms to serve their clients and efficiently grow their firms. We help plaintiff, personal injury. Cosmolex's built-in trust accounting software helps manage trust & operating accounts, perform audit-ready reconciliations with trust reports. All Products · Yourefolio · EstateExec · Giving Docs · Estateably · Trust & Will · Trustate · Clio · Amicus Attorney by CARET. The best user experience for the software-defined perimeter · Embrace a Zero Trust approach · Highlights · Stay resilient with Absolute ZTNA · Secure and optimized. CosmoLex is cloud-based law practice management software that integrates trust & business accounting, time tracking, billing, email & document management, and. Protect family assets! Create a Revocable Living Trust with easy-to-use software from Standard Legal. Step-by-step Q&A, instructions. No attorney required. Trust & Will is an online service provider that helps users with their by providing estate planning documents and information. Find and compare different software & technologies in the Trust Accounting industry. Automated trust portal software. This is software specifically designed to share secure information (like a SOC 2 or other security documents and FAQs) behind a. Revocable Living Trusts. Create a revocable living trust and fulfill many functions of a last will and testament. Also, placing assets in a trust can avoid. GoodTrust offers a will-based or trust-based estate plan that includes all the important directives your family needs for one affordable price. Meet the industry-leading trust intelligence platform for managing Privacy and Data Governance, GRC and Security, Ethics and Compliance Great Place to Work. Use Clio's trust account management software to track trust and operating accounts as required by legal industry regulators. Estate planning with Trust & Will is the easiest way to create, edit, store, and share your Trust or Will legal documents. Create an estate plan today! Use Clio's trust account management software to track trust and operating accounts as required by legal industry regulators.

Private Health Insurance Iowa

Wellmark Blue Cross and Blue Shield overview of HMO and PPO plans, pharmacy benefits, and other useful tools to help you select the coverage that's right. The University of Iowa offers two medical plans: UIChoice and UISelect. Regular faculty and staff with at least a 50 percent appointment and their eligible. Wellmark is the leading health insurance company in Iowa and South Dakota. Find individual and family plans and resources for Employers, Providers, and. HealthPartners offers a wide range of affordable individual, family, group and Medicare health insurance plans with extensive provider networks. Health Insurance Plan of Iowa (HIPIOWA) offers health insurance for individuals with serious health conditions who may have been denied coverage. Applicants can. HealthMarkets can find the right Iowa health insurance plan for you. Choose a Iowa health insurance plan with the coverage and price that fits your needs. Lowest premiums for SHOP health insurance plans in each "metal" category. Bronze, Silver, Gold, Platinum. Enrollee age up to 20, $, $, $ Individual and Family Health Insurance Companies in Iowa. Aetna; HS - Medica ; Dental Insurance Carriers in Iowa. Ameritas Life Insurance Corp. Dentegra. Individual health insurance plans and other options are available in Iowa year-round. Supplemental plans for dental, vision, accident insurance and more. Wellmark Blue Cross and Blue Shield overview of HMO and PPO plans, pharmacy benefits, and other useful tools to help you select the coverage that's right. The University of Iowa offers two medical plans: UIChoice and UISelect. Regular faculty and staff with at least a 50 percent appointment and their eligible. Wellmark is the leading health insurance company in Iowa and South Dakota. Find individual and family plans and resources for Employers, Providers, and. HealthPartners offers a wide range of affordable individual, family, group and Medicare health insurance plans with extensive provider networks. Health Insurance Plan of Iowa (HIPIOWA) offers health insurance for individuals with serious health conditions who may have been denied coverage. Applicants can. HealthMarkets can find the right Iowa health insurance plan for you. Choose a Iowa health insurance plan with the coverage and price that fits your needs. Lowest premiums for SHOP health insurance plans in each "metal" category. Bronze, Silver, Gold, Platinum. Enrollee age up to 20, $, $, $ Individual and Family Health Insurance Companies in Iowa. Aetna; HS - Medica ; Dental Insurance Carriers in Iowa. Ameritas Life Insurance Corp. Dentegra. Individual health insurance plans and other options are available in Iowa year-round. Supplemental plans for dental, vision, accident insurance and more.

NCQA Health Insurance Plan Ratings - Summary Report (Private/Commercial) ; United HealthCare Services, Inc. (Iowa). IA ; UnitedHealthcare. You can browse plans and estimated prices here any time. Next, you can log in to apply, see final prices, pick a plan, and enroll. In fact, 60% of people with private health insurance use at least one of Iowa residents will lose their health insurance. • , people's health. The average cost of health insurance in the state of Iowa is $6, per person based on the most recently published data. For a family of four, this translates. We offer a broad selection of Iowa health plans for individuals, families and small businesses from most of the leading Iowa health insurance companies. Iowa. Kansas. Kentucky. Louisiana. Maine. Maryland. Massachusetts. Michigan Private Insurance · Racial Equity and Health Policy · Uninsured · Women's Health. Need health insurance? You can enroll if you have certain life events or income, or you qualify for Medicaid or CHIP. Residents use sputnikbaikal.ru to compare plans and enroll in coverage. Three private insurance companies offer health plans through Iowa's exchange/Marketplace. Aetna offers health insurance, as well as dental, vision and other plans, to meet the needs of individuals and families, employers, health care providers. There is an annual Open Enrollment Period (OEP) when Iowa residents can buy or renew health insurance under the Affordable Care Act. The dates for Open. Start your quote today and you could save up to 50% over other health insurance in the market. Connect with an agent for your quote. Iowa Total Care is dedicated to transforming the health of our community one person at a time. Apply for Iowa health insurance plans and Medicaid services. Still need health insurance? You can enroll or change plans if you have certain life events or income, or qualify for Medicaid or CHIP. If you're self-employed, you can use the individual Health Insurance Marketplace ® to enroll in flexible, high-quality health coverage that works well for. Healthy and Well Kids in Iowa (Hawki), federally known as Children's Health Insurance Program (CHIP), provides health coverage to children and families. Iowa's Health Insurance Marketplace was created by the Affordable Care Act as a way to find health coverage that fits your budget and meets your needs. The University of Iowa offers two medical plans: UIChoice and UISelect. Regular faculty and staff with at least a 50 percent appointment and their eligible. If you need health insurance coverage in Iowa, you can enroll in an ACA-compliant major medical plan through the Iowa Marketplace (sputnikbaikal.ru) during the. The HIPP program is a way for the State of Iowa to save money. How can I get HIPP? You or someone in your home has to have Medicaid. You must have medical. Affordable, flexible and locally based Medicare and group health plans for Iowa and Illinois – from two trusted names in health care and insurance.

Pro Shares Oil

ProShares is the leader in strategies such as dividend growth, interest rate hedged bond and geared (leveraged and inverse) ETF investing. View the latest ProShares Ultra Bloomberg Crude Oil (UCO) stock price, news, historical charts, analyst ratings and financial information from WSJ. Find the latest ProShares Ultra Bloomberg Crude Oil (UCO) stock quote, history, news and other vital information to help you with your stock trading and. The ProShares Ultra Bloomberg Crude Oil seeks daily investment results, before fees and expenses, that correspond to two times (2x) the daily performance of the. View ProShares Ultra Bloomberg Crude Oil ETF (UCO) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. PROSHARES TRUST. ProShares Ultra Oil & Gas (DIG). ProShares UltraShort Oil & Gas (DUG). PROFUNDS. Oil & Gas UltraSector ProFund (Investor Class ENPIX. Performance charts for ProShares Ultra Bloomberg Crude Oil (UCO - Type ETF) including intraday, historical and comparison charts, technical analysis and. Analyst Report This ETF offers 2x daily leverage to an index that consists of crude oil futures contracts, making UCO a powerful tool for expressing a bullish. Learn everything you need to know about ProShares Ultra Bloomberg Crude Oil (UCO) and how it ranks compared to other funds. Research performance, expense. ProShares is the leader in strategies such as dividend growth, interest rate hedged bond and geared (leveraged and inverse) ETF investing. View the latest ProShares Ultra Bloomberg Crude Oil (UCO) stock price, news, historical charts, analyst ratings and financial information from WSJ. Find the latest ProShares Ultra Bloomberg Crude Oil (UCO) stock quote, history, news and other vital information to help you with your stock trading and. The ProShares Ultra Bloomberg Crude Oil seeks daily investment results, before fees and expenses, that correspond to two times (2x) the daily performance of the. View ProShares Ultra Bloomberg Crude Oil ETF (UCO) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. PROSHARES TRUST. ProShares Ultra Oil & Gas (DIG). ProShares UltraShort Oil & Gas (DUG). PROFUNDS. Oil & Gas UltraSector ProFund (Investor Class ENPIX. Performance charts for ProShares Ultra Bloomberg Crude Oil (UCO - Type ETF) including intraday, historical and comparison charts, technical analysis and. Analyst Report This ETF offers 2x daily leverage to an index that consists of crude oil futures contracts, making UCO a powerful tool for expressing a bullish. Learn everything you need to know about ProShares Ultra Bloomberg Crude Oil (UCO) and how it ranks compared to other funds. Research performance, expense.

ProShares Ultra Bloomberg Crude Oil ; Bloomberg Commodity Balanced WTI Crude Oil IndexSM. 46 ; Information About the Index Licensor. 48 ; DESCRIPTION OF THE. Assess the UCO stock price quote today as well as the premarket and after hours trading prices. What Is the ProShares Ultra Bloomberg Crude Oil Ticker Symbol? There is no guarantee any ProShares ETF will achieve its investment objective. Why Invest in OILK? • Provides exposure to crude oil futures in an ETF. •. Learn everything about ProShares Ultra Bloomberg Crude Oil (UCO). News, analyses, holdings, benchmarks, and quotes. This ProShares ETF seeks daily investment results that correspond, before fees and expenses, to 2x the daily performance of its underlying benchmark (the “Daily. Get ProShares Ultra Bloomberg Crude Oil (UCO) real-time share value, investment, rating and financial market information from Capital. ProShares Ultra Bloomberg Crude Oil. $ UCO %. United States Oil Fund LP. $ USO %. MicroSectors Energy 3X Inverse Leveraged Notes due January. Get ProShares Ultra Bloomberg Crude Oil (UCO:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. Invest in ProShares Ultra Bloomberg Crude OilUCO and other US listed companies from outside US. Easy onboarding, no account minimums, secure and simple. A high-level overview of ProShares Ultra Bloomberg Crude Oil ETF (UCO) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. ProShares Ultra Bloomberg Crude Oil UCO · NAV. · Open Price. · Bid / Ask / Spread. / / % · Volume / Avg. Mil / Mil · Day. ProShares. Ultra Bloomberg Crude Oil. View K-1 via PDF or TurboTax. Gain / Loss Calculations. Go Paperless. Call Us. () Make Updates Online. ProShares Ultra Bloomberg Crude Oil (UCO) · Top 0 Holdings (-- of Total Assets) · Sector Weightings · Overall Portfolio Composition (%) · Equity Holdings · Bond. Latest ProShares Ultra Bloomberg Crude Oil (UCO:PCQ:USD) share price with interactive charts, historical prices, comparative analysis, forecasts. The United States Oil Fund's (USO) investment objective is for the daily changes, in percentage terms, of its shares' net asset value (NAV) to reflect the. iShares US Oil & Gas Exploration & Production ETF. $ IEO %. ProShares Ultra Bloomberg Natural Gas. $ BOIL %. Iida Group Holdings Co Ltd. ProShares Ultra DJ-UBS Crude Oil seeks daily investment results that correspond to twice (%) the daily performance of the Dow Jones UBS Crude Oil Sub-Index. UCO - ProShares Trust II - ProShares Ultra Bloomberg Crude Oil Stock - Stock Price, Institutional Ownership, Shareholders (ARCA). Find the latest quotes for ProShares Ultra Bloomberg Crude Oil (UCO) as well as ETF details, charts and news at sputnikbaikal.ru Get comprehensive information about ProShares Ultra Bloomberg Crude Oil (USD) (USY) - quotes, charts, historical data, and more for informed.

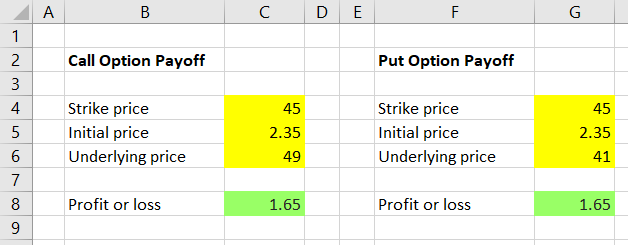

How To Calculate Profit On Options

Description. Options Profit Calculator just changed the options trading game. Building the perfect strategy is now possible. Whether you have already entered a. The Excel template has some VBA code in it, which calls MarketXLS functions to pull the option chains automatically. In this Options Profit Calculator all you. Use an Options Profit Calculator. The easiest way to calculate profits is to use a calculator. Many websites offer online options profit calculator tools. All. How is option profit calculated? Option profit is calculated using the formula: (Sale Price – Purchase Price) x Number of Contracts x What is the Black-. Put Option Profit or Loss Formula · strike price minus underlying price (if the option expires in the money) · zero (if it doesn't). The calculation is simple, involving the subtraction of the buy order and sell order at the index price, and the trading fee when the position hasn't yet. How is option profit calculated? The profit earned on an option held to expiry is the difference between the market price and the break-even price of the option. The #1 free option profit calculator (OPC). Build and visualize any options strategy with the most advanced option profit and loss tool. Probability of Profit (POP) is the likelihood of making at least $ buying/selling options, or reducing cost basis of stock. Learn how to calculate POP! Description. Options Profit Calculator just changed the options trading game. Building the perfect strategy is now possible. Whether you have already entered a. The Excel template has some VBA code in it, which calls MarketXLS functions to pull the option chains automatically. In this Options Profit Calculator all you. Use an Options Profit Calculator. The easiest way to calculate profits is to use a calculator. Many websites offer online options profit calculator tools. All. How is option profit calculated? Option profit is calculated using the formula: (Sale Price – Purchase Price) x Number of Contracts x What is the Black-. Put Option Profit or Loss Formula · strike price minus underlying price (if the option expires in the money) · zero (if it doesn't). The calculation is simple, involving the subtraction of the buy order and sell order at the index price, and the trading fee when the position hasn't yet. How is option profit calculated? The profit earned on an option held to expiry is the difference between the market price and the break-even price of the option. The #1 free option profit calculator (OPC). Build and visualize any options strategy with the most advanced option profit and loss tool. Probability of Profit (POP) is the likelihood of making at least $ buying/selling options, or reducing cost basis of stock. Learn how to calculate POP!

Call Options Profit Formula · Breakeven Point= Strike Price+Premium Paid · When the price of the underlying stock is more or equal to the strike price, then. An Options Profit Calculator is an online tool that allows you to analyze and visualize the potential returns, profit/loss, and risk/reward for various stock. Uncovered Options. Whether you were assigned early or auto-exercised on expiration you can quickly reconcile your P/L after an assignment or exercise with the. The calculator uses the latest price for the underlying symbol. Theoretical values and IV calculations are performed using the Black 76 Pricing model, which is. Call option profit calculator. Visualise the projected P&L of a call option at possible stock prices over time until expiry. OptionStrat's strategy builder is used to find the potential profit and loss at various prices, as well as show how your trade is affected by implied. The most advanced options profit calculator tool. Build and visualize strategies, optimize trading ideas, and view unusual options flow with OptionStrat. In this short article, I will show how to calculate the PoP of an options strategy using the Black-Scholes model provided that you know the stock price's PR. An options profit calculator, which enables you to see your potential gains and losses for a specific option strategy. profit on a call option is determined by the price difference between the underlying asset and the strike price within a specified time frame. Calculating profits (or losses) in option's trading is the same as you would calculate profits from any other type of trading. Call Options Profit and Breakeven The following is the profit/loss graph at expiration for the call option in the example given on the. Options. Print; Help/Glossary · Quotes & Tools · Market Overview Log in to calculate profit/loss potential for single- and multi-leg option strategies. A powerful options calculator and visualizer. Reposition any trade in realtime. Visualize your trades. Customize your strategies. A realtime options profit. If the buyer bought one options contract, their profit equals $ ($8 x shares); the profit would be $1, if they bought two contracts ($8 x ). Now. Options Calculator · Probability Calculator. Screeners. Morning Hot Sheet Profit/Loss. Portfolio Totals. Subscribers can save strategies. Auto Calculate. The profit is the negative of the premium paid because the option expires worthless. Put options profit formula. Use the following formula to calculate the. Calculate your potential profit from options trading. Options Type: Call Share Price $ Option Price $ Strike Price $ Number of Contracts: Each contract is Stock Options Profit Calculator. Mike Berner. Written By: Mike BernerSenior Analyst & Expert on Business Operations. Editor Verified. Editor Verified. A.

What Is The Long Term Capital Gain Tax

Long-term capital gains taxes occur when an asset has been sold after being owned for over a year. These taxes can have rates of 0%, 15% or 20% depending on. The taxable part of a gain from selling Internal Revenue Code Section qualified small business stock is taxed at a maximum 28% rate. Specifically, for. Gains from the sale of collectibles, such as art, antiques, coins, and precious metals, are subject to a higher long-term capital gains tax rate of 28%. Long-term capital gains are taxed at a lower rate than your ordinary income, taxation on long-term investment profits is more favorable than taxation on your. Realized capital gains face a top statutory marginal income tax rate of 20 percent plus a supplemental net investment income tax rate of percent, for a. They're usually taxed at lower long-term capital gains tax rates (0%, 15%, or 20%). Capital gains from stock sales are usually shown on the B. Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%. Even taxpayers in the top income tax bracket pay. "Net long-term capital gains" means net long-term capital gains as that term is defined in section of the Internal Revenue Code, 26 USC They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or. Long-term capital gains taxes occur when an asset has been sold after being owned for over a year. These taxes can have rates of 0%, 15% or 20% depending on. The taxable part of a gain from selling Internal Revenue Code Section qualified small business stock is taxed at a maximum 28% rate. Specifically, for. Gains from the sale of collectibles, such as art, antiques, coins, and precious metals, are subject to a higher long-term capital gains tax rate of 28%. Long-term capital gains are taxed at a lower rate than your ordinary income, taxation on long-term investment profits is more favorable than taxation on your. Realized capital gains face a top statutory marginal income tax rate of 20 percent plus a supplemental net investment income tax rate of percent, for a. They're usually taxed at lower long-term capital gains tax rates (0%, 15%, or 20%). Capital gains from stock sales are usually shown on the B. Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%. Even taxpayers in the top income tax bracket pay. "Net long-term capital gains" means net long-term capital gains as that term is defined in section of the Internal Revenue Code, 26 USC They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or.

Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing. Your taxable capital gain is generally equal to the value that you receive when you sell or exchange a capital asset minus your "basis" in the asset. Your basis. While the federal long-term capital gains tax applies to all states, there are eight states that do not assess a long-term capital gains tax. They are. After , the capital gains tax rates on net capital gain (and qualified dividends) are 0%, 15%, and 20%, depending on the taxpayer's filing status and. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. Capital gains from assets you have held for longer than one year are considered long-term capital gains and are taxed at a lower rate than short-term gains on. Long-term capital gains generally qualify for a tax rate of 0%, 15%, or 20%. Under the Tax Cuts and Jobs Act of , long-term capital gains tax rates are. Short-term capital gains are taxed as ordinary income at rates up to 37 percent; long-term gains are taxed at lower rates, up to 20 percent. Taxpayers with. The profits from selling assets not owned for the one-year holding period are known as short-term capital gains. There is no short-term capital gains tax, so. Short-term capital gains (for assets held for less than a year) are typically taxed at your ordinary income tax rate, which can range from 10% to 28%. Short-Term Capital Gains Tax Rates Short-term capital gains are taxed as ordinary income. Any income that you receive from investments that you held for one. The net amount of long-term capital gains is taxed at a 15% CIT rate, with the exception of capital gains from the sale of building land and similar assets (as. A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of. Generally, the gain is considered long-term if you hold an asset for more than one year. On a standalone basis, the first $94, () of long-term capital. Do I have to file a tax return if I don't owe capital gains tax? No. You are not required to file a capital gains tax return if your net long-term capital. You may have to make estimated tax payments if you have a taxable capital gain. Capital gain distributions are taxed as long-term capital gains regardless. Other sold assets will be taxed at long-term capital gains rates. The Federal rates are 0%, 15%, or 20%, depending on filing status and taxable income. Each. The maximum capital gains tax rate for individuals and corporations · – · % · %. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-. Different tax rates apply for long- and short-term capital gains. As of February 11, , the tax rate on most net capital gain is 15% for most individuals.

1 2 3 4 5