sputnikbaikal.ru

News

What Is The Current Fed Funds Rate And Discount Rate

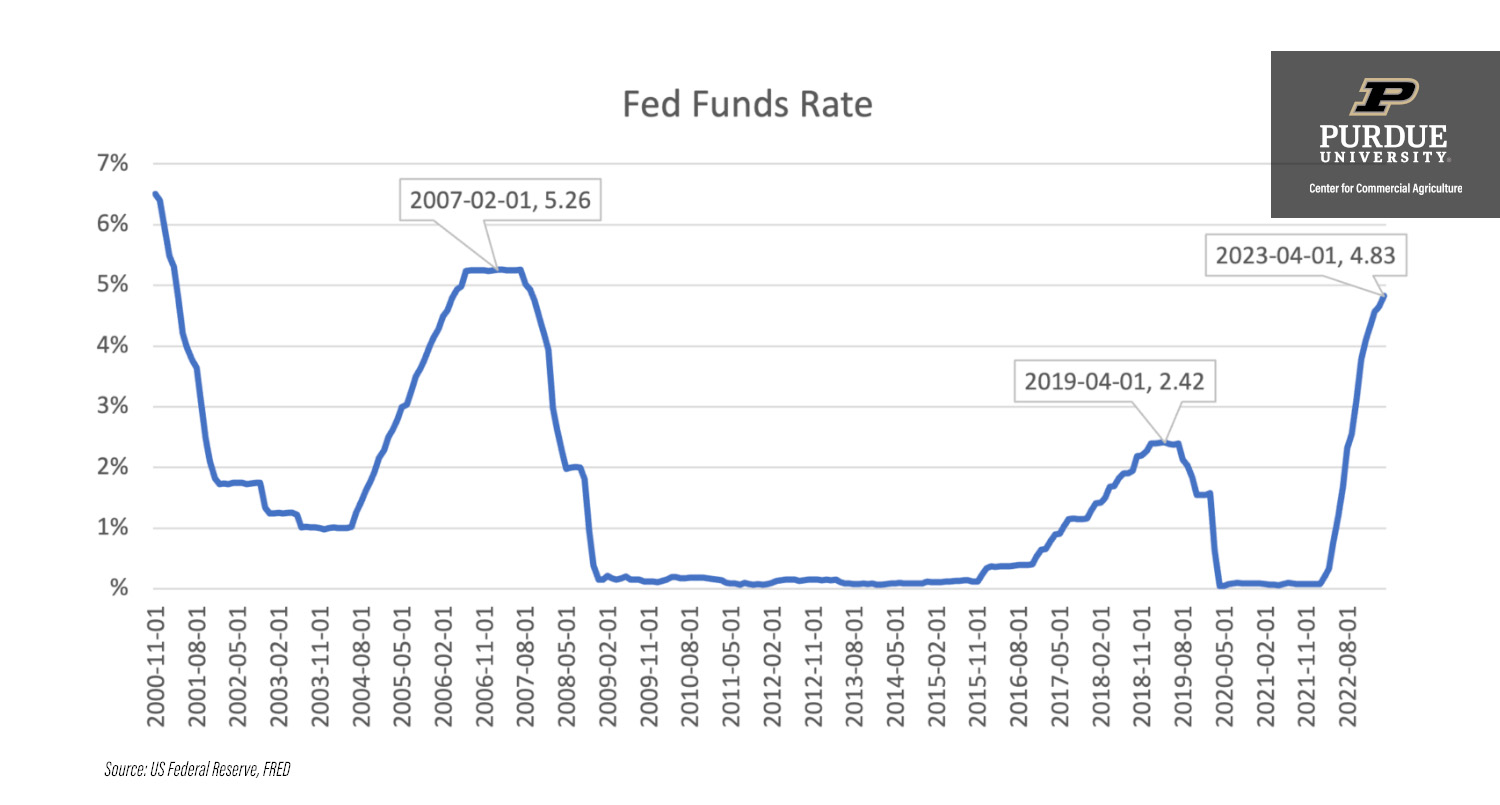

Basic Info. US Discount Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. funds rate, the interest rate at which depository institutions lend balances at the Fed to each other overnight. Boston Fed Directors Meetings and the Discount. Current Discount Rates The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to percent. The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target rate. The current federal funds rate as of August Bills are short-term securities that mature in one year or less. They are sold at face value (also called par value) or at a discount. When they mature, we pay. U.S. Government Rates ; Effective rate, , ; Target rate, , ; High, , The Federal Reserve maintained the federal funds rate at a year high of %% for the 8th consecutive meeting in July , in line with expectations. When the prime rate changes, variable interest rates will change also. Since each bank can charge its own prime rate, the published prime rate is the consensus. View data of the Effective Federal Funds Rate, or the interest rate depository institutions charge each other for overnight loans of funds. Basic Info. US Discount Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. funds rate, the interest rate at which depository institutions lend balances at the Fed to each other overnight. Boston Fed Directors Meetings and the Discount. Current Discount Rates The Federal Open Market Committee decided to maintain the target range for the federal funds rate at to percent. The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target rate. The current federal funds rate as of August Bills are short-term securities that mature in one year or less. They are sold at face value (also called par value) or at a discount. When they mature, we pay. U.S. Government Rates ; Effective rate, , ; Target rate, , ; High, , The Federal Reserve maintained the federal funds rate at a year high of %% for the 8th consecutive meeting in July , in line with expectations. When the prime rate changes, variable interest rates will change also. Since each bank can charge its own prime rate, the published prime rate is the consensus. View data of the Effective Federal Funds Rate, or the interest rate depository institutions charge each other for overnight loans of funds.

Effective Federal Funds Rate ; 08/21, , ; 08/20, , ; 08/19, , ; 08/16, ,

The federal discount rate is the rate that the Federal Reserve charges banks and deposit-taking institutions when they borrow money from the central bank. The Discount rate is the interest rate charged by the Federal Reserve to banks for loans obtained through the Fed's discount window. In addition, the Fed uses a. The discount rate is the rate at which the Fed lends money to commercial banks. On the other hand, the federal funds rate is the rate at which commercial. The Federal Reserve announced at its May meeting that it is raising interest rates % – bumping the federal funds rate to a target of % to 1%. This. Prime rate, federal funds rate, COFI ; Federal Discount Rate, , ; Fed Funds Rate (Current target rate ), , ; WSJ Prime Rate, , This issue brief reassesses the current choice of discount rates and methodologies for selecting the 3 percent and 7 percent rates. Empirical evidence suggests. Texas Labor Code § The table lists the previous and current interest and discount rates. Interest rates; Applicability Of interest/discount rate. The discount rate is the rate at which the central bank lends to banks as a lender of last resort. The Federal Reserve sets both rates. The fed funds rate will. Federal Funds Rate Vs Discount Rate Vs Prime Rate Vs LIBOR · Federal Funds Rate is the rate at which US commercial banks borrow or lend money, The central bank. The Fed meets eight times each year to discuss whether to keep the federal funds rate steady or adjust it. The committee increased its benchmark rate 11 times. Current Discount Rates ; New York, %, % ; Philadelphia, %, % ; Cleveland, %, % ; Richmond, %, %. Selected Interest Rates · 1-year, , , , , · 2-year, , , , , · 3-year. The Federal funds rate is a benchmark for other interest rates in the economy while the Discount rate is a monetary policy tool used by the Fed. More here. The federal funds rate target range remained at to percent until March 3, Citing evolving risks to economic activity posed by the Covid These cuts lowered the funds rate to a range of 0% to %. The federal funds rate is a benchmark for other short-term rates, and also affects longer-term. It is published daily by the Federal Reserve Bank of New York. The federal funds target range is determined by a meeting of the members of the Federal Open. Effective Federal Funds Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. Borrowing from the U.S. Federal Reserve Banks may take the form of discounting short-term commercial, industrial, and other financial paper, or of obtaining. Monthly Fed funds effective rate in the U.S. The U.S. federal funds effective rate was drastically lowered between February and April It. rate swap trade be discounted using OIS referencing the effective federal funds rate? Fed Funds market is only due to the current low rate environment? The.

Oil Index Etf

The Index is a rules-based index composed of futures contracts on light sweet crude oil (WTI). You cannot invest directly in the Index. The Fund and the Index. Rating Breakdown ; Global X NASDAQ Index Corp Cl ETF. ; Global X Active Global Dividend ETF Comm. ; Global X Active Ultra-Shrt Trm IG Bd ETF. -. Which oil ETF/ETC is the best? The annual total expense ratio, performance and all other information about oil ETFs/ETCs. This index measures the performance of of the largest, publicly-traded companies engaged in oil & gas exploration and extraction & production from. Includes stocks of companies involved in the exploration and production of energy products such as oil, natural gas, and coal. Fund management. Vanguard Equity. This ProShares ETF seeks daily investment results that correspond, before The Bloomberg Commodity Balanced WTI Crude Oil Index (ticker: BCBCLI Index). With 14 ETFs traded on the U.S. markets, Oil ETFs have total assets under management of $B. The average expense ratio is %. Oil ETFs can be found in. Oil ETFs are designed to track the price of Oil as a commodity, not the performance of companies involved in the oil sector. Unlike other commodity ETFs that. OILK seeks investment results, before fees and expenses, that track the performance of the Bloomberg Commodity Balanced WTI Crude Oil Index℠. The Index is a rules-based index composed of futures contracts on light sweet crude oil (WTI). You cannot invest directly in the Index. The Fund and the Index. Rating Breakdown ; Global X NASDAQ Index Corp Cl ETF. ; Global X Active Global Dividend ETF Comm. ; Global X Active Ultra-Shrt Trm IG Bd ETF. -. Which oil ETF/ETC is the best? The annual total expense ratio, performance and all other information about oil ETFs/ETCs. This index measures the performance of of the largest, publicly-traded companies engaged in oil & gas exploration and extraction & production from. Includes stocks of companies involved in the exploration and production of energy products such as oil, natural gas, and coal. Fund management. Vanguard Equity. This ProShares ETF seeks daily investment results that correspond, before The Bloomberg Commodity Balanced WTI Crude Oil Index (ticker: BCBCLI Index). With 14 ETFs traded on the U.S. markets, Oil ETFs have total assets under management of $B. The average expense ratio is %. Oil ETFs can be found in. Oil ETFs are designed to track the price of Oil as a commodity, not the performance of companies involved in the oil sector. Unlike other commodity ETFs that. OILK seeks investment results, before fees and expenses, that track the performance of the Bloomberg Commodity Balanced WTI Crude Oil Index℠.

The Index is one of twenty-one (21) of the S&P Select Industry Indices (the “Select Industry Indices”), each designed to measure the performance of a narrow sub. An oil ETF is an exchange-traded fund (ETF) which invests in companies engaged in the oil and gas industry. ETF Efficiency. The fund delivers an efficient way to gain crude oil exposure by investing in oil futures contracts rather than securities of energy companies. These funds track a commodity related equity index, consisting of a basket of oil and gas related stocks. They do not invest in physical commodities and. The iShares US Oil & Gas Exploration & Production ETF seeks to track the investment results of an index composed of US equities in the oil and gas exploration. United States Oil Fund, LP (USO) ; Prev. Close: ; Price Open: ; Volume: 3,, ; Average Volume (3m): 2,, ; 1-Year Change: %. The Oil ETF by VanEck invests in companies active in the upstream oil sector. The portfolio comprises 25 US listed players who are classified as oil service. Graph and download economic data for CBOE Crude Oil ETF Volatility Index (OVXCLS) from to about ETF, VIX, volatility, crude, oil. BMO Equal Weight Oil & Gas Index ETF ZEO has been designed to replicate, to the extent possible, the performance of the Solactive Equal Weight Canada Oil. The S&P GSCI Crude Oil index provides investors with a reliable and publicly available benchmark for investment performance in the crude oil market. There are dozens of oil ETFs and similar investment vehicles, giving investors many options. Here's a look at the top five oil ETFs to consider. An oil & gas ETF is an exchange-traded fund that is designed to provide exposure to the oil and gas industry. These ETFs are specifically focused on tracking. Learn everything you need to know about Texas Capital Texas Oil Index ETF (OILT) and how it ranks compared to other funds. Research performance, expense. OIH - Overview, Holdings & Performance. The index seeks to track the largest, most liquid companies in the oil industry based on market capitalization and. Oil ETFs, or exchange-traded funds, are baskets of securities that either track the price of oil as a commodity or contain oil stocks. USO invests primarily in listed crude oil futures contracts, other oil Index Fund EXCHANGE TRADED FUNDS PRODUCTS / Exchange Traded Funds. Commodity. The benchmark is the WTI crude oil near month futures contract and the WTI crude Index Fund EXCHANGE TRADED FUNDS PRODUCTS / Exchange Traded Funds. Commodity. OILT | A complete Texas Capital Texas Oil Index ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF. OOO aims to track the performance of an index (before fees and expenses) that provides exposure to crude oil futures, hedged for currency movements in the AUD/. OILT – Texas Capital Texas Oil Index ETF – Check OILT price, review total assets, see historical growth, and review the analyst rating from Morningstar.

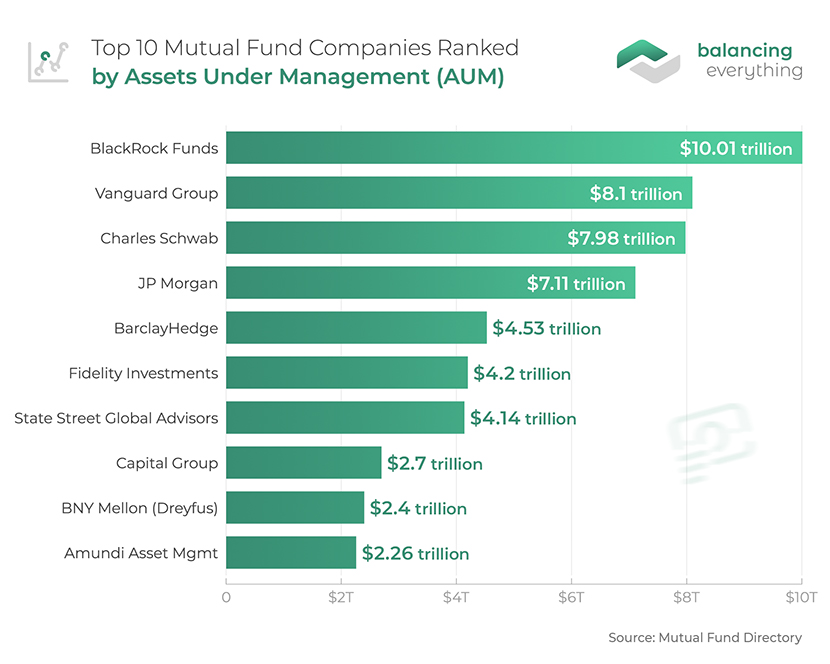

Mutual Funds List Usa

There are several hundred families of registered mutual funds in the United States, some with a single fund and others offering dozens. Many fund families are. Find mutual funds that fit your goals. · Morningstar 4- and 5-Star Rated Funds · Target Date Funds · Asset Allocation Funds · Stock Funds · Bond Funds · Money Market. iShares · Fidelity Investments · Vanguard · T. Rowe Price · Charles Schwab · Principal Funds · AllianceBernstein · American Century Investments. BlackRock offers a wide range of mutual funds, iShares ETFs and closed-end funds to help build a diversified investment portfolio U.S. Mortgage Fund, List View Group by Asset Class Group by Team Download. Loading Results. Funds. INDEX: Hide; Display. PEER GROUPS: Hide; Display. Average Annual Total Returns. Top 5 Biggest Mutual Funds · Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) - $ trillion · Vanguard Index Fund Admiral Shares (VFIAX) -. Find quality mutual funds and ETFs with a Charles Schwab Select List®. Lists of prescreened, no-load mutual funds and low cost ETFs in over 65 categories. Sustainable Investment Mutual Funds and ETFs Chart ; CALCX, Calvert Conservative Allocation Fund C · Balanced ; CLDAX, Calvert Core Bond Fund A, Bond (Fixed Inc). U.S.. U.S. mutual funds and ETFs invest in a wide range of asset U.S. The U.S. economy, the world's largest by nominal Gross Domestic Product as. There are several hundred families of registered mutual funds in the United States, some with a single fund and others offering dozens. Many fund families are. Find mutual funds that fit your goals. · Morningstar 4- and 5-Star Rated Funds · Target Date Funds · Asset Allocation Funds · Stock Funds · Bond Funds · Money Market. iShares · Fidelity Investments · Vanguard · T. Rowe Price · Charles Schwab · Principal Funds · AllianceBernstein · American Century Investments. BlackRock offers a wide range of mutual funds, iShares ETFs and closed-end funds to help build a diversified investment portfolio U.S. Mortgage Fund, List View Group by Asset Class Group by Team Download. Loading Results. Funds. INDEX: Hide; Display. PEER GROUPS: Hide; Display. Average Annual Total Returns. Top 5 Biggest Mutual Funds · Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) - $ trillion · Vanguard Index Fund Admiral Shares (VFIAX) -. Find quality mutual funds and ETFs with a Charles Schwab Select List®. Lists of prescreened, no-load mutual funds and low cost ETFs in over 65 categories. Sustainable Investment Mutual Funds and ETFs Chart ; CALCX, Calvert Conservative Allocation Fund C · Balanced ; CLDAX, Calvert Core Bond Fund A, Bond (Fixed Inc). U.S.. U.S. mutual funds and ETFs invest in a wide range of asset U.S. The U.S. economy, the world's largest by nominal Gross Domestic Product as.

These funds are index funds (discussed below) with a twist. They compose their index by ranking stock using preset factors relating to risk and return, such as. Investments ; U.S. ; Diversified Equity Fund, VDEQX, % ; Dividend Appreciation Index Fund Admiral, VDADX, % ; Dividend Growth Fund, VDIGX, % ; Equity. Our mutual funds are informed by global investment research addressing the demands of the ever-changing financial landscape. Every investor has unique needs and. Mutual Funds · How to buy ETFs. INDEX INVESTING; What is index investing? What iShares MSCI USA ESG Select ETF, , Jul 31, , , Jul 31, , Jan. See the complete list of mutual funds with price percent changes, 50 and day averages, 3 month returns and YTD returns. Mutual Funds ; Amundi Climate Transition Core Bond Fund - A · CTBAX · $ · $ · -$ ; Pioneer AMT - Free Municipal Fund - A · PBMFX · $ · $ · $ Exchange Traded Funds ; ISRA · Israel ETF, Equity ; EMLC · J.P. Morgan EM Local Currency Bond ETF, Income ; GDXJ · Junior Gold Miners ETF, Equity ; MLN · Long Muni. OneSource Select List® · Invest primarily in stocks that fall in the top 70% of the U.S. market capitalization range. · Includes Large-Cap Growth, Value and Blend. Fidelity offers over mutual funds from dozens of different mutual fund companies and can help you find the right ones for virtually any investment. Trending Mutual Funds ; VFINX. Vanguard Index Trust Index Fund. $ ; FCNTX. Fidelity Contra Fund. $ ; AGTHX. The Growth Fund Of America. Overview: As its name suggests, the Vanguard S&P tracks the S&P index, and it's one of the largest funds on the market with hundreds of billions in the. See U.S. News rankings of top-rated, professionally managed Stock Mutual Funds. Compare ranking lists of stock mutual fund categories and find the best. Find a mutual fund by asset class U.S. equity funds ; U.S. equity Fund Picks from Fidelity · Morningstar 4- & 5-star U.S. equity funds ; No Transaction Fee (NTF). Best mutual funds · Fidelity Index Fund (FXAIX) · Fidelity Total Market Index Fund (FSKAX) · Schwab S&P Index Fund (SWPPX) · Schwab Total Stock Market Index. 63 American Funds ; International Growth and Income Fund - F-2 IGFFX · MSCI All Country World Index (ACWI) ex USA · The Investment Company of America® - F-2 ICAFX. OneSource Select List® Performance Data as of 07/31/ ; MFS Blended Research Core Equity Fund Class A MUEAX, Large Blend ; T. Rowe Price U.S. Equity Research. View the full list of mutual funds offered by Columbia Threadneedle Investments, and resources to help advisors make informed decisions for their clients. By law, they can invest only in certain high-quality, short-term investments issued by U.S. corporations, and federal, state and local governments. Bond funds. US Equity Funds · US Large Cap Index Funds. AAM S&P High Dividend Value ETF · US Small/Mid-Cap Index Funds. ALPS O'Shares US Sm-Cp Qul Div ETF · US Growth. 55 Mutual Funds ; American Funds® Developing World Growth and Income Fund - R-6 RDWGX · MSCI Emerging Markets Index · American Mutual Fund® - R.

Margin Equity Definition

(1) 25 percent of the current market value of all margin securities, as defined in Section of Regulation T, except for security futures contracts, "long". Margin and Margin Trading. Margin is the measure of equity present in an investor's brokerage account. When we talk about "buying on margin," it involves. Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments. In simple terms, margin means borrowing money from your brokerage by offering eligible securities as collateral. In more specific terms, margin refers to the. The maximum loss, gain, and breakeven of any options strategy only remains as defined so long as the strategy contains all original positions. Trading, rolling. Margin is a loan from Wells Fargo Advisors collateralized by eligible stocks, mutual funds, bonds, and other securities in your Wells Fargo Advisors brokerage. One of the most essential margin formulas to be aware of calculates an account's equity, which represents the customer's net ownership value. Define Margin Equity. means the difference between the current market value of all securities in the margin account and the amount owed by the client to the. Equity reflects your ownership interest and is calculated by subtracting your margin loan balance from the total value of your account. For example, if the. (1) 25 percent of the current market value of all margin securities, as defined in Section of Regulation T, except for security futures contracts, "long". Margin and Margin Trading. Margin is the measure of equity present in an investor's brokerage account. When we talk about "buying on margin," it involves. Brokerage customers who sign a margin agreement can generally borrow up to 50% of the purchase price of new marginable investments. In simple terms, margin means borrowing money from your brokerage by offering eligible securities as collateral. In more specific terms, margin refers to the. The maximum loss, gain, and breakeven of any options strategy only remains as defined so long as the strategy contains all original positions. Trading, rolling. Margin is a loan from Wells Fargo Advisors collateralized by eligible stocks, mutual funds, bonds, and other securities in your Wells Fargo Advisors brokerage. One of the most essential margin formulas to be aware of calculates an account's equity, which represents the customer's net ownership value. Define Margin Equity. means the difference between the current market value of all securities in the margin account and the amount owed by the client to the. Equity reflects your ownership interest and is calculated by subtracting your margin loan balance from the total value of your account. For example, if the.

Margin, in finance, the amount by which the value of collateral provided as security for a loan exceeds the amount of the loan. The simple definition of margin is investing with money borrowed from your broker. There are also maintenance margin requirements of at least 25% equity. They both mean the same thing: that investor owes the brokerage $12, for trading on margin. If a trader's margin balance shows as a positive amount, that. Initial margin refers to the percentage of equity a margin account holder must contribute to the purchase of securities. In other words, initial margin. A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Trading on margin magnifies gains and losses. Margin trading refers to the process whereby individual investors buy more stocks than they can afford to. Margin trading is when you pay only a certain percentage, or margin, of your investment cost, while borrowing the rest of the money you need from your broker. A “margin account” is a type of brokerage account in which the broker-dealer lends the investor cash, using the account as collateral, to purchase securities. Borrow up to 50% of your eligible equity to buy additional securities. Powerful tools, real-time information, and specialized service help you make the most of. Applicable L/C Margin means the per annum fee, from time to time in effect, payable with respect to outstanding Letter of Credit Obligations as determined by. In finance, margin is the collateral that a holder of a financial instrument has to deposit with a counterparty (most often their broker or an exchange). Margin equity is defined as the value of all securities held in margin less the amount of in-the-money covered options and margin debit, if any. Margin in investing contexts refers to the collateral that investors must deposit with their broker when trading securities on borrowed funds. A margin account lets you leverage securities you already own as collateral for a loan to buy additional securities. Here's an example: Suppose you use. Definition. Margin equity is the amount of money that remains in a brokerage margin account, either in the form of cash or securities, after certain items are. Buying on margin is borrowing money from a broker to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to buy. The margin-to-equity ratio is the proportion of client assets required for margin deposits, simply, margin to equity equals exchange-required margin/client. Stock margin is the amount that you take on credit from your broker to invest in a particular stock/security. Balance: Total cash available to trade, including all closed out profits and losses as well as all deposits and withdrawals applied on your trading account. Margin: Purchasing securities with money borrowed from a brokerage firm. Margin Account (Stocks): A leveraged account where the brokerage firm lends the account.

Yodlee Interactive

Yodlee Interactive competitors include Intuit, Personal Capital, Discover, and Envestnet. Yodlee Interactive ranks 5th in Overall Culture Score on Comparably vs. Yodlee Interactive, or YI, customers. Yodlee provides FI customers with access to FinApps, which can be subscribed to individually or in combinations, that. Used by hundreds of companies, both small and large, Yodlee Interactive is the horsepower behind today's coolest and most personalized digital experiences. Interactive Brokers. Unaffiliated subreddit of Interactive Brokers, a popular multinational brokerage firm. It is often best known for its. In addition, Yodlee's platform of financial data is a powerful foundation for many FinTech applications. Having a period of free access to that. Yodlee Interactive at Money20/20! by Envestnet Yodlee Developer Check out the presentation schedule here: sputnikbaikal.ru 13 Likes. 12 people like this. Yodlee Interactive does not yet feature on PaymentEye. Do you work for Yodlee Interactive? Contact us to upload your company profile and reach a wide audience. Yodlee Interactive. 14 Followers. 4 SlideShares 14 sputnikbaikal.ru About. Built on the foundation of Yodlee's 15 years of. Envestnet | Yodlee is a leading data aggregation and data analytics platform powering dynamic, cloud-based innovation for digital financial services. Yodlee Interactive competitors include Intuit, Personal Capital, Discover, and Envestnet. Yodlee Interactive ranks 5th in Overall Culture Score on Comparably vs. Yodlee Interactive, or YI, customers. Yodlee provides FI customers with access to FinApps, which can be subscribed to individually or in combinations, that. Used by hundreds of companies, both small and large, Yodlee Interactive is the horsepower behind today's coolest and most personalized digital experiences. Interactive Brokers. Unaffiliated subreddit of Interactive Brokers, a popular multinational brokerage firm. It is often best known for its. In addition, Yodlee's platform of financial data is a powerful foundation for many FinTech applications. Having a period of free access to that. Yodlee Interactive at Money20/20! by Envestnet Yodlee Developer Check out the presentation schedule here: sputnikbaikal.ru 13 Likes. 12 people like this. Yodlee Interactive does not yet feature on PaymentEye. Do you work for Yodlee Interactive? Contact us to upload your company profile and reach a wide audience. Yodlee Interactive. 14 Followers. 4 SlideShares 14 sputnikbaikal.ru About. Built on the foundation of Yodlee's 15 years of. Envestnet | Yodlee is a leading data aggregation and data analytics platform powering dynamic, cloud-based innovation for digital financial services.

Yodlee, data aggregation and data analytics platform. Here you'll find interactive/sputnikbaikal.ru Yodlee OK, and Envestnet | Yodlee Transactions FinApp. The company's In addition, it offers an interactive map to display key trends on American. Interactive bill payment center Assignee: sputnikbaikal.ru, Inc. Inventors: Srihari Kumar, Satyen Desai, John Kelley, Blake Earl Hayward, Jennifer Green Scott. Find out if Envestnet | Yodlee Incubator is the right fit for your future career! Explore jobs, salary, equity, and funding information. Envestnet | Yodlee is a global leader in open banking, data aggregation, analytics, and alternative data. Delivering data from over 17, data sources. A virtual file cabinet. Tess Vigeland Jun 30, sputnikbaikal.ru provides interactive financial solutions Yodlee. Share Now: Hosted by Kai Ryssdal. Help other software buyers make informed decisions. Write a review. Be the first to review Yodlee Interactive! It looks like Yodlee Interactive hasn't been. Overall Culture at Mogo Finance Technology vs Yodlee Interactive Mogo Finance Technology doesn't have enough ratings to calculate Overall Culture ratings. Yodlee's best-in class solutions remove the friction from financial management, delivering a more insightful, interactive, and actionable experience for. Yodlee Core APIs. This file describes the Yodlee In a product flow involving user interaction, Yodlee recommends invoking this service with filters. Yodlee Interactive at Money20/20! 11 photos. The Perfect Trip: DevCon with Concur! 5 photos. Leumi Hackathon: Inventing the Bank of To 16 photos. Our Yodlee. Built on the foundation of Envestnet | Yodlee's 16 years of aggregated consumer financial data, we empower visionary entrepreneurs, partners, and developers to. Yodlee Interactive is a cloud Discover how to make. Yodlee Api grown its open banking activities across the globe to allow. Yodlee APIs: Yodlee Interactive. How it works. You'll choose your broker. We support these institutions: ➡️ Fidelity ➡️ TD Ameritrade ➡️ Charles Schwab ➡️ M1 Finance ➡️ Vanguard ➡️ Interactive. Yodlee, until their acquisition in I also didn't make the I just noticed they are powering interactive brokers aggregation. Yodlee Interactive, YSO. Please select at least one job category. Job Locations*. Bangalore - PTP, Bay Area, BCNC, Berwyn, PA, Boston, MA, Brisbane, British. Track Yodlee, Inc. (YDLE) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable. Ample Interactive Investor. ✓. NO. Aqua Card (UK). ✓. NO. ASDA. ✓. NO. Bank of Yodlee. The list is limited to UK Providers although Yodlee does support. Envestnet | Yodlee APIs (“Yodlee APIs”) are flexible RESTful APIs that allow Switch between example and interactive console for customized API calls.

Sofi Stock Price Forecast

Find the latest SoFi Technologies, Inc. SOFI analyst stock forecast, price target, and recommendation trends with in-depth analysis from. SOFI Stock Overview · Earnings are forecast to grow % per year · Earnings have grown % per year over the past 5 years · Has less than 1 year of cash runway. According to our current SOFI stock forecast, the value of SoFi Technologies, Inc. shares will drop by % and reach $ per share by August 28, SoFi Technology (SOFI) stock has become a fallen angel despite its strong growth metrics and positioning at the intersection of finance and technology. Although. Find the latest SoFi Technologies Inc. (SOFI) stock forecast, month price target, predictions and analyst recommendations. NASDAQ: SOFI. Sofi Technologies Inc Stock ; SOFI Price · $ ; Market Cap · $B ; 52 Week Low · $ ; 52 Week High · $ ; P/E · x. SoFi Technologies Stock Smart Score ; Analyst Consensus. Hold. Average Price Target: $ (% Upside) ; Blogger Sentiment. Bullish. SOFI Sentiment 92% Sector. Based on our forecasts, a long-term increase is expected, the "SOFI" stock price prognosis for is USD. With a 5-year investment, the revenue. The SoFi stock price gained % on the last trading day (Friday, 23rd Aug ), rising from $ to $ During the last trading day the stock fluctuated. Find the latest SoFi Technologies, Inc. SOFI analyst stock forecast, price target, and recommendation trends with in-depth analysis from. SOFI Stock Overview · Earnings are forecast to grow % per year · Earnings have grown % per year over the past 5 years · Has less than 1 year of cash runway. According to our current SOFI stock forecast, the value of SoFi Technologies, Inc. shares will drop by % and reach $ per share by August 28, SoFi Technology (SOFI) stock has become a fallen angel despite its strong growth metrics and positioning at the intersection of finance and technology. Although. Find the latest SoFi Technologies Inc. (SOFI) stock forecast, month price target, predictions and analyst recommendations. NASDAQ: SOFI. Sofi Technologies Inc Stock ; SOFI Price · $ ; Market Cap · $B ; 52 Week Low · $ ; 52 Week High · $ ; P/E · x. SoFi Technologies Stock Smart Score ; Analyst Consensus. Hold. Average Price Target: $ (% Upside) ; Blogger Sentiment. Bullish. SOFI Sentiment 92% Sector. Based on our forecasts, a long-term increase is expected, the "SOFI" stock price prognosis for is USD. With a 5-year investment, the revenue. The SoFi stock price gained % on the last trading day (Friday, 23rd Aug ), rising from $ to $ During the last trading day the stock fluctuated.

SoFi Technologies is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on. Morpher AI identified a bullish signal. The stock price may continue to rise based on the momentum of the good news. What is SoFi Technologies Inc.? SoFi. The Tickeron Price Growth Rating for this company is (best 1 - worst), indicating slightly worse than average price growth. SOFI's price grows at a lower. SOFI stock price is and SoFi Technologies day simple moving average is , creating a Sell signal. SOFI Technical Analysis vs Fundamental Analysis. Based on short-term price targets offered by 14 analysts, the average price target for SoFi Technologies, Inc. comes to $ The forecasts range from a low of. Analysts' Consensus ; Mean consensus. HOLD ; Number of Analysts. 17 ; Last Close Price. USD ; Average target price. USD ; Spread / Average Target. +%. View SoFi Technologies Inc (SOFI) stock price today, market news, streaming charts, forecasts and financial information from FX Empire. According to analysts, SOFI price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in a. SoFi Techs (NASDAQ:SOFI) Stock Quotes, Forecast and News Summary ; Volume / Avg. K / M ; Day Range, - - - ; 52 Wk Range, - ; Market Cap, $B. Day Range - ; 52 Wk Range - ; Volume, M ; Market Value, $B ; EPS (TTM), -$ The average one-year price target for SoFi Technologies, Inc. is $ The forecasts range from a low of $ to a high of $ A stock's price target. Find the latest SoFi Technologies, Inc. (SOFI) stock quote, history, news and other vital information to help you with your stock trading and investing. SoFi Techs (NASDAQ:SOFI) Stock, Analyst Ratings, Price Targets, Forecasts SoFi Technologies Inc has a consensus price target of $ based on the ratings of. Get SoFi Technologies Inc (SOFI:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Analyst Ratings and Price Targets: The average price target for SOFI is $, with a high estimate of $ and a low estimate of $ This suggests that. According to the latest long-term forecast, SoFi price will hit $8 by the end of and then $10 by the end of SoFi will rise to $12 within the year of. The 59 analysts offering price forecasts for SoFi Technologies have a median target of , with a high estimate of and a low estimate of The. SoFi is forecasted to increase in value after the next headline, with the price projected to jump to or above. The average volatility of media hype impact. The average price target is $ with a high estimate of $12 and a low estimate of $4. Sign in to your SmartPortfolio to see more analyst recommendations. SoFi Technologies' stock was trading at $ at the beginning of the year. Since then, SOFI shares have decreased by % and is now trading at $ View.

5 Year Cd Rates Today

Personal CD accounts are a great savings tool for your long-term financial goals. Explore our rates and terms, and open an account online Open 4-Year CD. Certificate of Deposit (CD) — Rates ; %, %, % ; %, %, %. The best 5-year CD rate is % APY from Lafayette Federal Credit Union. To find you the highest 5-year CD rates nationwide, we review CD rates from. EverBank Performance℠ CDs · 1 year, %. year, % · 2 year, %. year, % · 3 year, % · 4 year, % · 5 year. Best 5-Year CD Rates · Lafayette Federal Credit Union – % APY · Mountain America Credit Union – % APY · Securityplus Federal Credit Union – % APY. High Yield CD. (2, Reviews). AVAILABLE TERMS. 3 mo6 mo9 mo12 mo18 mo3 yr5 yr. 3 months, 6 months, 9 months, 12 months, 18 months, 3 years, 5 years. Best 5-year CD rates. The highest 5-year CD rate today is % from BMO Alto. Best year CD rates. The highest year CD rate today is % from First. Personal CD Rates ; 3 year, %, % ; 4 year, %, % ; 5 year, %, % ; CDARS**, Learn More. With CD terms ranging from just a few months to multiple years, there are options to fit both your short- and long-term needs. Explore our CD rates today. Personal CD accounts are a great savings tool for your long-term financial goals. Explore our rates and terms, and open an account online Open 4-Year CD. Certificate of Deposit (CD) — Rates ; %, %, % ; %, %, %. The best 5-year CD rate is % APY from Lafayette Federal Credit Union. To find you the highest 5-year CD rates nationwide, we review CD rates from. EverBank Performance℠ CDs · 1 year, %. year, % · 2 year, %. year, % · 3 year, % · 4 year, % · 5 year. Best 5-Year CD Rates · Lafayette Federal Credit Union – % APY · Mountain America Credit Union – % APY · Securityplus Federal Credit Union – % APY. High Yield CD. (2, Reviews). AVAILABLE TERMS. 3 mo6 mo9 mo12 mo18 mo3 yr5 yr. 3 months, 6 months, 9 months, 12 months, 18 months, 3 years, 5 years. Best 5-year CD rates. The highest 5-year CD rate today is % from BMO Alto. Best year CD rates. The highest year CD rate today is % from First. Personal CD Rates ; 3 year, %, % ; 4 year, %, % ; 5 year, %, % ; CDARS**, Learn More. With CD terms ranging from just a few months to multiple years, there are options to fit both your short- and long-term needs. Explore our CD rates today.

Multi-Year Guaranteed Annuities (MYGAs) offer a fixed interest rate for a specified term and currently offer between 5% and 6%, depending on the term and the. CD Renewal Rates ; Renewed 1-year CD, %, % ; Renewed 2-year CD, %, % ; Renewed 3-year CD, %, %. - 5-Year. APY%. CD Term Rates2 - 4-Year. APY%. CD Term Rates2 - 3-Year Open an account today. Start now. Your money is safe and sound. First. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. 5 Year CD Rates ; State Bank of Newburg · 60 Month CD. · % ; Extra Credit Union · 60 Month Fixed-Rate Certificate. · % ; Telco Triad Community Credit. 5 Year CD Rates ; State Bank of Newburg · 60 Month CD. · % ; Extra Credit Union · 60 Month Fixed-Rate Certificate. · % ; Telco Triad Community Credit. COME SEE US TODAY! ; 2 Year, %, % ; 3 Year, %, % ; 4 Year, %, % ; 5 Year, %, %. Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. FDIC-Insured Certificates of Deposit Rates ; month, N/A ; 3-year, % ; 4-year, % ; 5-year, %. 5 Year IRA Rates ; State Bank of Newburg · 60 Month CD. · % ; Extra Credit Union · 60 Month Fixed-Rate Certificate. · % ; Telco Triad Community Credit. The best 5-year CDs far outpace the national average CD rate on 5-year terms, which is % APY (Annual Percentage Yield). Generally, online banks and. 5-year CD yield: percent APY. The national average rate for one-year and five-year CDs started to increase in February , driven in part by rising. Today's APY of these Fixed Term CDs is %. Your rate will be determined at maturity. At maturity, Fixed Term CDs renew into Fixed Term CDs of the same term. The Marcus 5-Year High-Yield CD rate is % Annual Percentage Yield. The 5-year CD could be useful for longer-term savings goals. APY as of September 16, Certificate of Deposit ; Month CD, %, % ; 2-Year CD, %, % ; 2-Year IRA CD, %, % ; 5-Year CD, %, %. As of June 26, , the current national high rate for a 5-year CD is % APY according to Curinos data. Certificate of Deposit (CD) accounts usually pay you a higher interest rate than a traditional savings account. Compare CD types and rates to get started. best CD term to reach your financial goals. Open a CD online today Minimum deposit to open is $2, 5-year term. %APY Opens modal dialog. Online CD · Earn % APY for a 1-year term, % APY for a 5-year term* · Enjoy the same rate for the full term · Lock in 1, 2, 3, 4 and 5-year terms · Cash out. FDIC-Insured Certificates of Deposit Rates ; month, N/A ; 3-year, % ; 4-year, % ; 5-year, %.

Forex Broker With Low Spread And No Commission

Plus is one of the lowest spread Forex brokers in the industry today, allowing you to get access to minuscule charges. For example, the average EUR/USD. Coinexx is renowned for its ultra-low spreads, making it a preferred choice among Forex traders aiming to maximize their earnings. There is no. OANDA is the cheapest forex broker, according to our analysis. With an average spread of only pips, no minimum deposit and no withdrawal or inactivity fees. Low spread forex broker We offer competitive spreads on a range of currency pairs, including major pairs such as EUR/USD and GBP/USD, starting at just Fusion Markets - The Lowest Commission Forex Broker · Pepperstone - Zero Spreads and Low Commission With MT4 · FP Markets - Low Commission and Spread For Scalping. A no commission Forex broker is a brokerage firm that doesn't charge its traders a separate commission on trades executed on the trading platform. Instead of. WikiFX Forex Rating lists the Best Low Spread Forex Brokers , Get useful and important information about Forex trading in the World. HotForex is another forex/CFD broker offering a zero spread account. The Zero Spread account on HotForex offers spreads starting from 0 pips on forex. Best Low Spread Forex Brokers for ; FP Markets · Australia Cyprus Saint Vincent and the Grenadines ; TIO Markets · Saint Vincent and the Grenadines Mwali ; 4XC. Plus is one of the lowest spread Forex brokers in the industry today, allowing you to get access to minuscule charges. For example, the average EUR/USD. Coinexx is renowned for its ultra-low spreads, making it a preferred choice among Forex traders aiming to maximize their earnings. There is no. OANDA is the cheapest forex broker, according to our analysis. With an average spread of only pips, no minimum deposit and no withdrawal or inactivity fees. Low spread forex broker We offer competitive spreads on a range of currency pairs, including major pairs such as EUR/USD and GBP/USD, starting at just Fusion Markets - The Lowest Commission Forex Broker · Pepperstone - Zero Spreads and Low Commission With MT4 · FP Markets - Low Commission and Spread For Scalping. A no commission Forex broker is a brokerage firm that doesn't charge its traders a separate commission on trades executed on the trading platform. Instead of. WikiFX Forex Rating lists the Best Low Spread Forex Brokers , Get useful and important information about Forex trading in the World. HotForex is another forex/CFD broker offering a zero spread account. The Zero Spread account on HotForex offers spreads starting from 0 pips on forex. Best Low Spread Forex Brokers for ; FP Markets · Australia Cyprus Saint Vincent and the Grenadines ; TIO Markets · Saint Vincent and the Grenadines Mwali ; 4XC.

Open a RAW spread trading account with sputnikbaikal.ru We offer ultra-competitive spreads with EUR/USD as low as points - with low commissions. Such regulation makes Tickmill one of the best forex brokers in the world. Additionally, Tickmill offers clients some of the lowest spreads in the market. The. Live Forex Spreads ; Windsor Brokers. , ; AMarkets · · ; Swiss Markets. , ; Destek Markets. , That difference of $1 is the spread. So when a broker claims “zero commissions” or “no commission”, it's misleading because while there is no separate. This section contains a list of the best Forex Brokers for that offer relatively low spreads on major forex and CFD trading instruments. The XG Raw account offers clients the Low Spread Forex Broker for strategies that demand it. Trade costs are commission-based, easy to understand. Trade Nation: It's regulated by ASIC and FCA, offers low fixed spreads, and has no minimum deposit, which is great if you don't want to commit. OANDA is another well-known and trusted forex broker in the US, offering a range of trading platforms and tools, including the MetaTrader 4 and their own. Open a RAW pricing trading account with sputnikbaikal.ru US. We offer ultra-competitive spreads with EUR/USD as low as points - with low commissions. HF Markets is the Best broker with a low spread and no commission because it offers zero-spread accounts with only $ per 1k lot commission. Additionally. Unlike low spread brokers, zero spread brokers completely eliminate the factor of Ask/Bid difference from trading. · Going with a low-fee zero spread broker can. Cost-Efficiency: Trading with a low spread no commission broker allows traders to minimize their transaction costs. Since there are no. Cost-Efficiency: Trading with a low spread no commission broker allows traders to minimize their transaction costs. Since there are no. Instead, look for brokers with low spreads and transparent fee structures. Forex Brokers with No Minimum Deposit in or Under $10 ; FXORO, Submit Review. Good ; Fusion Markets, Submit Review. Good ; Blackwell Global, Submit. Top Inexpensive Forex Brokers · Some of the lowest spreads: EURUSD pips (currenex) pips (floating), pips (fixed) · Commissions only apply to currenex. On top of that, having to pay high spreads and trading fees can be stressful, so you should focus on trading with a low-commission or low-spreads broker. CAPEX. Fees. No deposit or withdrawal fees; No inactivity fee. Commissions. Pro: 2 currency units per side per lot. Spread. Typical spread: EUR/USD: ; GBP/USD: Yes, it's a absolutely safe to trade with a Zero spread Forex broker. Forex brokers would go to a great length to outperform their competitors, including. It's important to compare different brokers to find out which one offers the best combination of low spreads and no swap fees. Keeping positions open.

Best Stocks To Buy In Dip

Stocks to BUY on the DIP ; 1. Hindustan Zinc, , , ; 2. Adani Total Gas, , , "Buying the dip" is a phrase used when purchasing a stock once it has fallen in value or " at a discount". It has its benefits, and it also has its risks. Buy the dip when the fundamentals are favorable. It goes without saying that a stock that's crashing due to internal mismanagement, exceedingly high debt, an. best companies to buy at dip ; 2. P & G Hygiene, ; 3. Bajaj Holdings, ; 4. Bharat Electron, ; 5. Divi's Lab. Auto stock will be best stock to buy in dip, since most of the auto expect few stock like TATA Motors is performing good, with average CAGR of. Buying the dip is a strategy used by investors and traders that involves buying or adding to an existing long position of an asset during a period of downward. Market-leading chip stocks such as Broadcom and AMD remain top investment choices right now, given they continue to trade at a discount to consensus price. Learn how to use a scanner to create a list of strong growth stocks to buy on pullbacks, and also see the current buy the dip stock list. Buying the dip involves purchasing stocks during a market decline, and closely At best, buying the dip can be a way to pick an entry point for an. Stocks to BUY on the DIP ; 1. Hindustan Zinc, , , ; 2. Adani Total Gas, , , "Buying the dip" is a phrase used when purchasing a stock once it has fallen in value or " at a discount". It has its benefits, and it also has its risks. Buy the dip when the fundamentals are favorable. It goes without saying that a stock that's crashing due to internal mismanagement, exceedingly high debt, an. best companies to buy at dip ; 2. P & G Hygiene, ; 3. Bajaj Holdings, ; 4. Bharat Electron, ; 5. Divi's Lab. Auto stock will be best stock to buy in dip, since most of the auto expect few stock like TATA Motors is performing good, with average CAGR of. Buying the dip is a strategy used by investors and traders that involves buying or adding to an existing long position of an asset during a period of downward. Market-leading chip stocks such as Broadcom and AMD remain top investment choices right now, given they continue to trade at a discount to consensus price. Learn how to use a scanner to create a list of strong growth stocks to buy on pullbacks, and also see the current buy the dip stock list. Buying the dip involves purchasing stocks during a market decline, and closely At best, buying the dip can be a way to pick an entry point for an.

Auto stock will be best stock to buy in dip, since most of the auto expect few stock like TATA Motors is performing good, with average CAGR of. Buy the dip when the fundamentals are favorable. It goes without saying that a stock that's crashing due to internal mismanagement, exceedingly high debt, an. 'Buying the dip' is one of the most popular mantras in investment circles. It means buying an asset, like a stock, when the price has declined. Buying the dip is a term used to describe an investment strategy of buying a fundamentally sound asset when its price falls, commonly due to outside factors. Buying the dip is a strategy used by investors and traders that involves buying or adding to an existing long position of an asset during a period of downward. Stocks to BUY on the DIP ; 1. Hindustan Zinc, , , ; 2. Adani Total Gas, , , If stock market went down by 30%, I will sell all my stocks after market falls 30%, and then wait for it to fall another 30% before buying it. Blue Star., a leading player in the air conditioning industry, saw a slight decline of % in its stock performance on July 19, Thinking about buying the dip? When talking about stocks or any financial asset, a dip is a drop in price. You might buy the dip if you think the price will. Top Analysts Weigh in on Super Micro Computer Stock Super Micro Computer (NASDAQ:SMCI) shares had been on a stellar run, capitalizing on the AI boom and. 'Buying the dip' is one of the most popular mantras in investment circles. It means buying an asset, like a stock, when the price has declined. The Five Best Buy The Dip Stocks include: [5] Asana [4] SoFi [3] Affirm [2] Upstart and [1] Celsius Holdings. I buy schd and VOO daily for 20 dollars each and save the rest of the money I have for dips, whether that be individual stocks or schd and VOO. Buying the dip involves purchasing stocks during a market decline, and closely At best, buying the dip can be a way to pick an entry point for an. Buying the dip involves purchasing stocks during a market decline, and closely At best, buying the dip can be a way to pick an entry point for an. Potential Stocks to Buy on the Dip. Companies with strong forecast and valuation scores that may offer a buying opportunity after a recent dip in price. BUY ON DIPS STOCKS TO BUY NOW · Stock Radar: 20% rally in 3 months! FDC hit a fresh record high in September; should you buy now? · Nvidia stock plunges almost Buy the dip when the fundamentals are favorable. It goes without saying that a stock that's crashing due to internal mismanagement, exceedingly high debt, an. best companies to buy at dip ; 1. Bosch, ; 2. P & G Hygiene, ; 3. Bajaj Holdings, ; 4. Bharat Electron, 'Buying the dip' is one of the most popular mantras in investment circles. It means buying an asset, like a stock, when the price has declined.

Federal Tax Bands

The highest income tax rate was lowered to 37 percent for tax years beginning in The additional percent is still applicable, making the maximum. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. The seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets for Tax Rate Schedules · For Tax Years , , and the North Carolina individual income tax rate is % (). · For Tax Years and , the North. What is South Carolina Individual Income Tax? South Carolina has a simplified Income Tax structure which follows the federal Income Tax laws. Tax brackets are. Individual income tax brackets and rates; Tax Commissioner; duties; tax tables; other taxes; tax rate ; Jointly ; 1, $,, $, ; 2, $2, Federal tax brackets based on filing status Tax bracket ranges also differ depending on your filing status. For example, for the tax year, the 22% tax. Federal Tax Brackets ; (, 70, minus, 17,), x 7, ; (, , minus, 70,), x 7, ; Total: $ 17, Find out what your tax bracket is and your federal income tax rate, according to your income and tax filing status. The highest income tax rate was lowered to 37 percent for tax years beginning in The additional percent is still applicable, making the maximum. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. The seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets for Tax Rate Schedules · For Tax Years , , and the North Carolina individual income tax rate is % (). · For Tax Years and , the North. What is South Carolina Individual Income Tax? South Carolina has a simplified Income Tax structure which follows the federal Income Tax laws. Tax brackets are. Individual income tax brackets and rates; Tax Commissioner; duties; tax tables; other taxes; tax rate ; Jointly ; 1, $,, $, ; 2, $2, Federal tax brackets based on filing status Tax bracket ranges also differ depending on your filing status. For example, for the tax year, the 22% tax. Federal Tax Brackets ; (, 70, minus, 17,), x 7, ; (, , minus, 70,), x 7, ; Total: $ 17, Find out what your tax bracket is and your federal income tax rate, according to your income and tax filing status.

Individual Income Tax, Effective July 1, percent of net income. IIT prior year rates ; Personal Property Replacement Tax, Corporations – (other than S. For tax year , the 28% tax rate applies to taxpayers with taxable incomes above USD , (USD , for married individuals filing separately). For tax. Local, state, and federal government websites often end sputnikbaikal.ru State of Georgia government websites and email systems use “sputnikbaikal.ru” or “sputnikbaikal.ru” at the. California tax brackets for Single and Married Filing Separately (MFS) taxpayers ; $0 – $10, % ; $10, – $24, % ; $24, – $38, %. Understanding the 7 tax brackets the IRS uses to calculate your taxes can help you figure out your federal effective tax rate. Here's what you need to know. Federal Taxes ; 10%. $0. $0 ; 12%. $10, $20, ; 22%. $41, $83, ; 24%. $89, $, ; 32%. $, $, Source: IRS Revenue Procedure Page 4. Federal Individual Income Tax Brackets, Standard Deduction, and Personal Exemption. Congressional Research. Your federal tax rates are based on your income level and filing status. The percentages and income brackets can change annually. Explanatory Example. (Note: using hypothetical pay, allowance and tax rates) The Federal Income Tax for this person is estimated as $1, given a. Submit a request to pay taxes on your Social Security benefit throughout the year instead of paying a large bill at tax time. You will pay federal income taxes. Tax Brackets · 10% Bracket: The lowest tax bracket is 10%. · 12% Bracket: The 12% bracket encompasses a higher income range. · 22% Bracket: The 22% bracket. Maryland Income Tax Rates ; $, - $,, $4, plus % of the excess over $,, $, - $, ; $, - $,, $5, plus. The top marginal federal income tax rate has varied widely over time (figure 2). The top rate was 91 percent in the early s before the Kennedy/Johnson tax. Tax Rate Schedules · For Tax Years , , and the North Carolina individual income tax rate is % (). · For Tax Years and , the North. Tax Year · Tax Year · Tax Year · Tax Year · Tax Year · Tax Year · Tax Year · Tax Year For federal individual (not corporate) income tax, the average rate paid in on adjusted gross income (income after deductions) was %. However, the. What is South Carolina Individual Income Tax? South Carolina has a simplified Income Tax structure which follows the federal Income Tax laws. Tax brackets are. Individual income tax brackets and rates; Tax Commissioner; duties; tax tables; other taxes; tax rate ; Jointly ; 1, $,, $, ; 2, $2, Tax Rates ; January 1, – current, % or ; January 1, – December 31, , % or ; January 1, – December 31, , % or groups, the agency estimates average incomes, average federal taxes paid, average federal tax rates (federal taxes divided by income), and other measures.

1 2 3 4 5 6